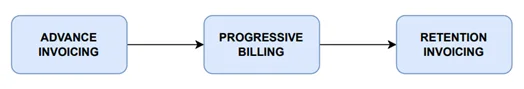

Managing advance and retention is pivotal to maintaining smooth financial operations in project-based industries such as construction, real estate development, or any other project-driven business. For organizations using Business Central ERP solutions, integrating these payment processes with a reliable system is essential for ensuring transparency and maximizing profitability. In this blog post, we explore how NB Projects – a powerful add-on for Microsoft Dynamics 365 Business Central, streamlines advance payment tracking, progressive billing and retention accounting.

Understanding Advance & Retention in Project Billing

What is an Advance Payment in Project Accounting?

Advance refers to the upfront payment made to a contractor, subcontractor, or service provider before the commencement of a project or at its initial stages. This advance payment helps cover initial project costs, such as purchasing materials, mobilizing resources, and other preliminary expenses.

What is Retention Payment in Project Accounting?

Retention typically refers to the practice of withholding a portion of payments to be received from the Customers / made to subcontractors until the completion of the project or a certain period (commonly known as the defect liability period) after the project completion is achieved.

Benefits of Managing Advance & Retention Payments Effectively

This practice is common in construction and other project-based industries to ensure that the work is completed satisfactorily and that any defects or issues are resolved before the final payment. By leveraging advance, retention, and progressive billing functionalities, organizations can streamline their project receivables process, improve cash flow visibility, and make data-driven decisions to optimize project profitability.

I. Managing Advance and Retention in Customer Billing

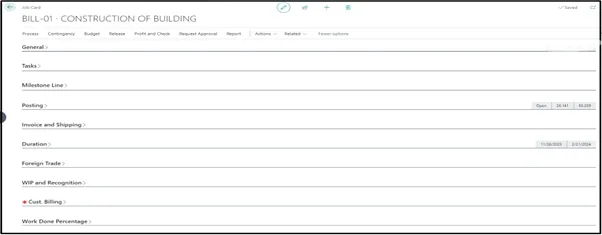

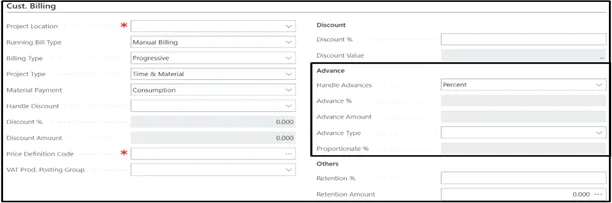

Advance and Retention can be defined at the project level.

Working of Advance Management

The Advance Tab includes the following details:

1. Advance %: Calculated as a percentage of the total project value. This determines the initial amount of advance payment agreed in the contract.

2. Advance Amount: Derived from multiplying the project value by the advance percentage, indicating the specific monetary value of the advance.

3. Advance Type: Specifies how the advance amount is allocated across progressive customer billing:

– Manual: The advance amount is manually entered and distributed across each progressive bill as needed.

– First Invoice: The entire advance amount is allocated to the initial progressive bill.

– Proportionate to Work Done: The advance is distributed based on the percentage of work completed for each progressive bill, automatically based on the percentage of completion against each task.

– Last Invoice: The entire advance amount is allocated to the final progressive bill.

For invoicing & receipt:

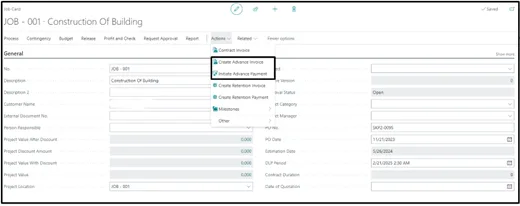

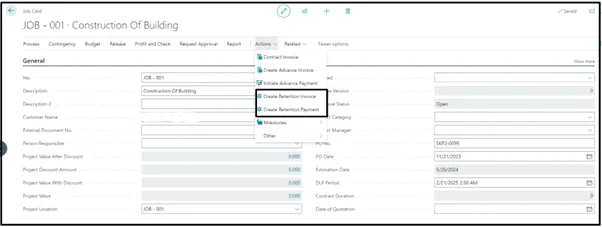

The advance sales invoices are issued to customers to bill them for advance payments received before the start of the project or service. These invoices can be generated as a single invoice or they can be issued in stages through the Create Advance Invoice action, reflecting agreed-upon advance amounts at different milestones or stages of the project.

Post the cash receipt journal against the Advance receipt, we can select the Initiate advance payment action in the Job card, where the entry will be created for getting posted.

Working of Retention Management

The Retention column includes the following details –

Retention %: This represents the percentage of each progressive bill that will be retained or withheld until the completion of the project or contract milestones. It indicates how much of the invoice amount is set aside as security or guarantee.

Retention amount: This column shows the actual monetary value of the retention amount being held back for each invoice.

For invoicing & receipt:

Once the work is completed and the conditions of the contract have been met, the retention money is released. For the Retention money invoicing, we must make use of the Create Retention Invoice action, where a retention invoice will be created. Retention invoice can be made in full or on a proportionate basis based on the contract terms. Record the Retention receipt of this retention money, we can select the Create Retention Payment Action, where the Cash receipt journal will be created for getting posted.

Progressive Billing for Customers in Dynamics 365 Business Central

Progressive billing is the process of billing our customers based on the proportion of work completed or milestone achieved.

1. Generate Progressive Sales Invoice

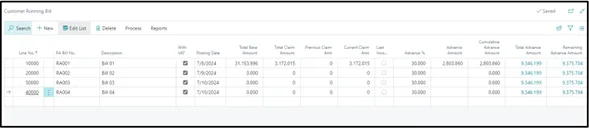

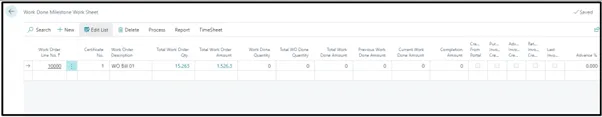

– From the Job Card, you can access the Customer Running Bill page.

– Here, you can create Progressive Sales Invoices to bill customers based on the percentage of work completed or milestones achieved.

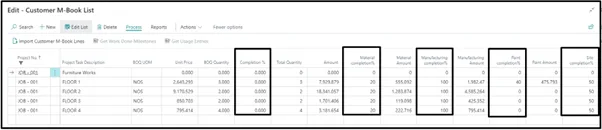

2. Customer Measurement Book (M Book)

Completion Percentage:

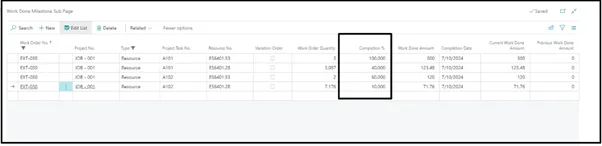

– Each billing line will have a Customer Measurement Book attached, where you can specify the percentage of completion.

Task Breakdown:

– The M Book allows for specifying completion percentages directly or dividing the work into tasks (e.g., site completion, manufacturing completion) for more detailed billing.

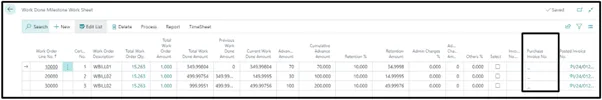

3. Calculations for Progressive Billing

The system calculates the amount to be billed based on the completion percentage specified in the M Book.

– The system adjusts the advance receipts, and retention amounts proportionately according to the completion status.

– The advance and invoice values are constrained by the amounts specified in the Job Card and the total project value after adjustments.

– The system assigns the Retention values to the specific G/L account to allocate the retention value to the trial balance.

4. Payment Processing

– After generating the progressive invoices, you can raise payments against each posted sales invoice.

– Post the payment journal entries for record-keeping and financial tracking.

– Payment received from the customer / paid to the contractor, against the invoice, shall be paid, deducting the retention value.

5. Final Billing

– Once the final bill is issued, it indicates the completion of the project and concludes the progressive billing process.

– Contract Closure: After the retention invoicing is completed and the retention money is received, the contract ends. This signifies the completion of the project or service as per the contractual terms.

– This feature enhances the transparency & accountability of financial transactions and helps maintain a smooth, mutually beneficial relationship between your company and the customer/contractors & ensures that your accounting system integrates effectively with your project system.

II. Working of Retention & Advance in Subcontractor Billing

In today’s business landscape, focusing on core operations is crucial, prompting many organizations to outsource supplementary activities to subcontractors or third parties. For efficient management of these engagements, we have developed a specialized module tailored for Subcontractor Invoicing within our system.

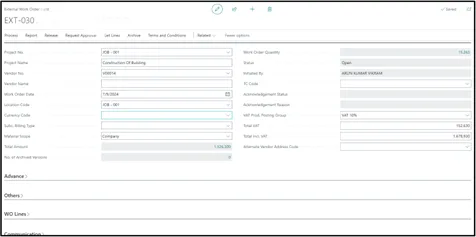

Like our streamlined Customer Billing process, our Subcontractor Invoicing module operates within a function known as the External Work Order. This module facilitates seamless transactions and functions for subcontractor engagements, ensuring clarity and efficiency throughout the invoicing process.

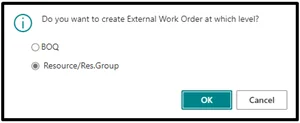

The external work order against the project can be of two types,

– Resource / Resource groups – If we are going to outsource only the persons/resources and are going to use our site materials, we would select this category.

– BOQ – If we are going to outsource both resources & materials (back-to-back), then we will select this category.

– If we select BOQ while selecting the External work order and process the BOQ lines of the relevant job tasks will appear i.e., the individual items & resources will be pulled from the relevant selected job tasks to the lines.

– If we select Resource / Resource Group & process, the individual resources from the job tasks & will be created as individual lines.

You will be required to update the unit cost for each of the WO/BOQ lines so the total cost will be calculated, and this Total amount will serve as the base for advance calculation & progressive vendor billing & payments.

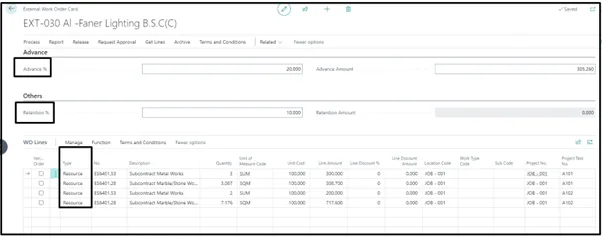

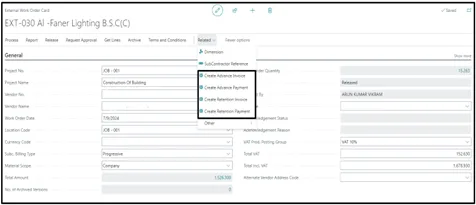

Like the customer running bill, we have a provision to provide the Advance & Retention percentages or amount for the progressive billing by the subcontractors. Also, we will be able to create the advance & retention invoices & payment journals against these invoices.

Progressive Billing for Subcontractors in Dynamics 365 Business Central

Progressive billing is the process of billing our Vendors to make payments based on the proportion of work completion or milestone achieved. Our system will be able to generate a Progressive Purchase Invoice after adjusting the advance receipts based on the advance type provided & the retention due amount based on the % provided in the work order card on a proportionate basis. From the external work order card, you will be able to navigate to the Subcontractor Measurement book. Against each M-Book line, there will be a milestone details subpage attached.

In the Milestone details subpage, all the BOQ / Resource WO lines will be processed. Against each of the lines, we must provide the percentage of completion of that relevant resource/material.

Then, exit, the M Book lines will be processed. Then select the Create Invoice action. A Purchase Invoice will be created.

For each of the M-Book lines, you will be able to create a purchase invoice restricted to the sum of the Total Cost of the BOQ/WO lines and the advance amount calculated & captured. After posting the final invoice & application of payment against the same, the Progressive billing process is completed.

III. Reporting in advance and retention for Customer & Subcontractor Billing

A. Advance

1. Dimension Setup:

– Create Dimension Code: Configure a dimension code (project-wise / customer-wise / vendor-wise) for tracking advances. This will allow you to segregate and monitor advance payments related to each project.

– Project as Dimension: Use each project as a dimension to track transactions related to expenses, income, and advance payments separately. This will facilitate detailed profit and cost centre analysis.

2. Job Card & External Work Order Card:

– Detailed Information: Maintain detailed records of advance payments and receipts on job cards and external work order cards. Key information includes:

– Total advance received.

– Balance due

– Cumulative advance received/paid.

– Apportionment of advances against progressive bills or invoices

3. Financial Reporting:

– Account Schedules: Configure account schedules to generate reports tracking advance transactions. Reports can include:

– Total advances receivable

– Advances received.

– Outstanding due

4. Analysis by Dimensions:

– Project Commercials: Use the analysis by dimensions view to monitor project commercials, including advances and retention payments. This view helps in tracking:

– Project-related advances

– Trends and overdue amounts

B. Retention

1. Dimension Setup:

– Create Dimension Code: Configure a dimension for tracking retention, such as “Retention” or “Customer & Subcontractor Retention.” This dimension will help in monitoring the retention of project monies.

– Apply Dimension to Transactions: Tag transactions related to retention payments and related transactions with this dimension to track:

– Retention received from customers.

– Retention paid to subcontractors.

2. Job Card & External Work Order Card:

– Detailed Information: Maintain detailed records of retention payments on job cards and external work order cards. Key details include:

– Total retention

– Balance due

– Due date

– Liability period details

– Apportionment of retention against progressive bills or invoices

3. Financial Reporting:

– Account Schedules: Configure account schedules to create reports focused on retention. Reports can summarize:

– Retention amounts received from customers.

– Retention amounts payable to subcontractors.

By leveraging reporting capabilities in Business Central, you can effectively manage and analyse retention received against projects. This enhances financial control, transparency, and operational efficiency in your project management processes.

Conclusion: How NB Projects Improves Financial Oversight

Managing advance and retention payments is a critical aspect of successful project accounting and financial control. The NB Projects add-on for Microsoft Dynamics 365 Business Central enables businesses to define, track, and automate these payments with precision. By streamlining advance payment processing, retention management, and progressive billing, organizations can improve transparency, enhance cash flow visibility, and drive project profitability.

Ready to streamline your project financials?

Contact us today to see how NB Projects can transform your billing and accounting workflows in Dynamics 365 Business Central.

Credit: Arun Kumar Vikram and Business Central Practice Team